Introduction & Purpose

Knowledge update and Industry update at Skyline University College (SUC) is an online platform for communicating knowledge with SUC stakeholders, industry, and the outside world about the current trends of business development, technology, and social changes. The platform helps in branding SUC as a leading institution of updated knowledge base and in encouraging faculties, students, and others to create and contribute under different streams of domain and application. The platform also acts as a catalyst for learning and sharing knowledge in various areas.

Artificial Intelligence embraces different technologies such as machine learning, natural language processing, sentinel analysis, among others, and becomes an integral part of our lives.

Dr. Wilson Gachiri

Accounting & Finance

The transport sector plays an important contribution to any given economy. The more advanced the transport infrastructure the more likely the economy will grow and vice versa.

Dr. Wilson Gachiri

Accounting & Finance

United Arab Emirates (UAE) is reported to be the second-largest economy in the MENA region with a gross domestic product (GDP) of 434 billion as of 2018. In the past, for example in 2012, oil revenues contributed a third of the GDP or 70 per cent of the country's gross domestic product (GDP). This is, however, is likely to reduce as a result of recent fall oil prices. The fall in oil prices has made the UAE economy to no longer depend on oil revenues for sustained growth. The UAE government has embarked on policies aimed at diversifying its economy, for example, the 10-year visa for private investors, designed to encourage private investment and attract a wider range of economic activities.

Non–oil revenues are expected to propel and accelerate economic growth in UAE in response to the government's newly introduced policies. Oxford Economics is forecasting non-oil GDP growth of 3.6 per cent in 2019, up from 3 per cent the previous year[1]. By 2015 sectors such as the media, tourism and other non-traditional revenue earners increased to 70 percent of the UAE's GDP. The travel and tourism sector in 2015 directly contributed USD 18.7 billion which is equivalent to 5.2 per cent of the total GDP, and with the diversification policies, the economy is expected to grow at higher levels. It is estimated that by 2021, international tourists will spend $43.8 billion (Dh160 billion) on bags, shoes, jewellery, and other items at retail shops across Dubai[2], making the city one of the world’s top shopping destinations. However, the recently introduced 5 % value-added tax (VAT) in the untested territory, is likely to result in unprecedented impacts in the retail market.

The tax is argued might act as a disincentive to shop in popular retail outlets with unlikely purges in retail sales . To safeguard against a possible backlash in sales, the UAE Federal Tax Authority (FTA)[3] has announced a tax refund scheme for eligible tourists. Starting in November 2018, international tourists may request refunds of value-added tax (VAT) incurred on their purchases from registered retail outlets. Tourists will be able to claim back 85 per cent their VAT on goods they have purchased in the UAE. The remaining 15 per cent will be charged in administration fees to Planet, the global operator of the refund system. Posters on the storefronts of registered stores will be displayed for easier visibility to the visitors with minimum spending of Dh 250 to claim a tax refund. Tourists can claim the refund within 90 days of their purchase. The FTA explained that a special device has been created at the point of departure where refunds will be received from purchases of registered outlets.

Documents required include the tax invoice from the 4000 registered retail outlets, along with copies of their passport and credit cards. Departing tourists will have the option of getting their refunds in dirhams or deposited their credit cards. The scheme is designed “to attract and retain larger numbers of tourists and allows them to enjoy the UAE's unique tourism offering, especially in retail shopping" sentiments expressed by Khalid Ali Al Bustani, director-general-FTA [1] Oxford Economics is a leader in global forecasting and quantitative analysis comprising more than 1,500 international corporations, financial institutions, government organizations, and universities. [2] Data was from Dubai Chamber of Commerce [3] UAE Federal Tax Authority (FTA) is responsible for collecting of federal receipts.

Dr. Wilson Gachiri

From Different Corners

UAE recently hosted a series of international forums on Non-communicable diseases (NCD’s). The Third Global NCD (Non-Communicable Diseases) Alliance Forum 2020 was under the theme of "Bridging the Gaps" was inaugurated by His Highness Dr. Sheikh Sultan Bin Mohammad Al Qasimi, UAE Supreme Council Member and Ruler of Sharjah. Sheikh Sultan previously highlighted the extreme need to hold an international gathering of like-minded individuals from across the globe, saying that NCDs have become a burden to every country[1]. His Highness stressed the need to combine efforts that protect people’s health and wellbeing by promoting healthy habits and promoting campaigns against bad lifestyle choices. Jose Luis Castro, President of the NCD Alliance, in his speech drew attention to the crucial role of civil society to stimulate equitable progress by 2025 and 2030: “Here in Sharjah, we took critical steps as a movement to identify how we can accelerate the implementation of life-saving and transformative policies; and how to strengthen our movement to deliver change”[2].

Chronic diseases require long term, costly and specialist treatment.

Combating NCDs remains a major economic challenge to countries celebrating an increase in life expectancy rates as a result of improved economic status, but are bemoaning increases in the so-called lifestyle diseases. Approximately 300 million people in the world have diabetes, with the number predicted to rise above 435 million by the year 2030 (IDF, 2013) In the Gulf Corporation Council region (GCC) investments made in healthcare since the first oil boom has started paying dividends. GCC nationals are enjoying much longer lives where average life expectancy across the region has increased from 60 years in the late '70s to 75 years in 2012 (IDF, 2013; Hu, 2011). However, the same GCC nationals are likely to suffer from health complications where the Western lifestyle has replaced the traditional lives and traditional eating habits.

Urbanization and rising personal wealth, for example, have prompted many a local population to reject active outside activities and instead embraced fondness of processed foods and detestation of physical exercises. Chronic diseases and obesity-related illness, previously uncommon in this region are on the rise. The US management consultant McKinsey & Company forecasts that the total cost of healthcare delivery in the Gulf will increase to nearly $60bn by 2025, up from $12bn in 2007 (Rahim, Sibai, Khader, et al, 2014).

In the United Arab Emirates (UAE) - a major economic powerhouse in the Gulf region- recent data suggest that 20% of the population has been diagnosed with diabetes and another 18% are at risk of developing it. Diabetes rates in UAE and the Gulf region are forecast to triple by 2030, from 1.5 million cases in 2000 to 4 million in 2030 representing the second-highest prevalence rates in the world (Ibid). The health cost of diabetes management is likely to rise to 43 billion dollars imposing a substantial financial burden not only on the UAE economy but also on many households in the country. The forum (in one of its series) concluded by observing that civil society has the mandate of working with governments to enact policies that promote healthy lifestyles for example increased physical activities and improved diets.

The World Health Organization estimated deaths from NCDs in the UAE to be 65 per cent out of 9,700 deaths. In 2017, the Ministry of Finance in the UAE introduced fiscal policies (value-added taxes) on selected goods and services. Such taxes are imposed for the primary purpose of achieving better health outcomes for the entire population. It is estimated that the UAE could raise a revenue of about 1.6 per cent of GDP from VAT in the first year following its introduction[3]. The proceeds of the food-related taxes could be used to fund or subsidize health programs and health insurance, diversify the government’s health spending away from the government’s direct payout. It is envisaged that taxes on sugar-related items like sodas and tobacco products will reduce consumption of sodas and tobacco products, eventually lowering levels of diabetes and diseases related to tobacco use for example lung cancer.

Fast forward to February of 2020, the UAE government through the Ministry of Health, reduced the prices of 573 medicines, between 2 per cent and 74 per cent- the largest in quantity and quality for chronic diseases[4]. It is expected the reduced prices of medicines will ease the financial burden on patients and contribute to their access to the world's best and most modern drugs at affordable prices, especially those with chronic diseases.

The 2020 forum was organized by the NCD Alliance in partnership with the local host organization, Friends of Cancer Patients. Nearly 400 delegates from 80 countries attended the Forum from 9-11 February in Sharjah, UAE. Delegates included representatives from 53 national and regional NCD alliances, civil society from cross-cutting areas relating to NCDs, youth leaders, academia, and people living with NCDs, NCD Alliance supporters, global stakeholders, and recognized champions. Over the course of three days, the delegates participated in 5 plenaries and 18 workshops, discussing NCD advocacy, building synergies, and sharing tools and strategies to further the NCD response[5].

REFERENCES

Hu, F.B. (2011). Globalization of diabetes: the role of diet, lifestyle, and genes. Diabetes Care,

34:1249–1257

International Diabetes Federation (2013). Diabetes Atlas. 6th ed. International Diabetes Federation.

Rahim, H.F., Sibai, A., Khader, Y., Hwalla, N., Fadhil, I., Alsiyabi, H., Mataria, A., Mendis, S., Mokdad, A.H., & Husseini, A. (2014). Non-communicable diseases in the Arab world. The Lancet; 383(9914):356-67.

World Health Organization (2008). Nine voluntary global targets with a framework of 25 indicators to curtail the escalation of the chronic disease.

[1] Gulf News Feb 2020

[2] Third NCD Alliance Sharjah 2020

[3] Shailesh Jha, an economist at ADCB Gulf News, June 2017

[4] Ministry of Health bulletin Gulf News Feb 2020.

[5] NCD Alliance report 2020

Dr. Petr Svoboda

From Different Corners

There are a lot of different investment opportunities in 2020 and because everyone’s resources are limited, people have to make a decision on where to invest their time and money. This decision is to a large extent depending on a potential return, but mostly on the need, willingness, and ability to take a risk.

The highest potential return and the lowest risk at the same time can be achieved if people decide to invest in themselves. Investing time and money into any form of education is usually the best investment people can make, especially when they are young. Learning a useful skill such as picking up a new language, designing a website, or developing an application for Android can bring a better paying job in the future, or even opportunity for starting their own business with less risk involved and greater success rate.

When thinking about starting a business, many people imagine a scary process of leaving a job and jumping into the unknown. It is important to realize that starting or running a business does not have to be a full-time activity. According to The Hartford (2018), 25% of the US citizens have some sort of a side business while continuing their full-time job. This research is suggesting that launching a side business is becoming a common practice and that in 2020 the field can become large enough for anyone to start their own venture.

To minimize risk even further, many ways of starting a business today do not require a large upfront investment. People only need to take advantage of this opportunity and implement their ideas in practice to reap the benefits in the form of extra income the business might quickly start generating.

The extra revenue generated by the side business is the most obvious reason why people launch new ventures. But the research is showing there are other reasons too. Many people feel stuck in their full-time jobs without being financially or emotionally fulfilled and the idea of starting a business offers them an opportunity to do the kind of work they enjoy.

While starting a business might still seem off-putting for some, others might realize that spending some extra hours on doing what they like thinking how to transform it into an income-generating business can eventually pay off. Moreover, the side hustle soon becomes a primary source of income and wealth for many.

When thinking about which business to start, people should first focus on their passions, talents and specific skills they have, whether work-related or not. This will increase both the motivation and experience needed to make the business successful.

While having a lot of extra money allow people to comfortably invest in a more passive, automatic way, investing in education or starting a business can be the best investment anyone can make in 2020 – whether to generate extra income or to simply spread the wings and get away from feeling stuck in the current position.

References:

The Hartford (2018) No Business Is Too Small for Insurance. Available at: https://mms.businesswire.com/media/20180925005605/en/680213/1/TheHartford_Side_Business_Survey_InfographicFINAL.pdf.

Prof. Haitham Alzoubi

From Different Corners

One of the determents of success for any person in the past was based on an intelligence test IQ, that measures memory, analytical thinking and mathematical capabilities, and thus the possibility of predicting future success in work. Recently, Emotional Intelligence also a determent of success which measure the ability to communicate with people and control feelings and skills of expression, as it contributes significantly to achieving success on many levels of life. There is no doubt that traditional intelligence and emotional intelligence play an important role in achieving professional success. But finally, in the digital transformational era and the field of Artificial Intelligence capabilities in work, and its skills for success, a new type of intelligence appeared that represent the ability of the mind to understand the changes in the environment in the right way and right time and take the proper action. The mind able to process a high level of analysis and the ability to adapt and response and deal with environmental uncertainty effectively. "Adaptive Intelligence" is not only the ability to understand new information, but also to be able to select the appropriate ones and discard useless information, as well as to overcome challenges and a conscious pursuit of change. This type of intelligence is coupled with flexibility, a passion for knowledge, courage and the ability to challenge difficulties and enjoy the skills of solving dilemmas.

Will the "Adaptive Intelligence" in the environmental uncertainty become more important for professional success compared to traditional intelligence? Technologies have dramatically changed the performance of many jobs and will continue to change. Having such skills would be better to do the work more quickly and accurately. And in order for the employee to maintain his/her role, he/she must acquire new creative skills that enable him/her to solve emerging problems as well as the ability to understand and communicate better and accountability with the use of human hyper intuition to have better performance results.

The three forms of intelligence are integrated to achieve success, as it helps the organization to overcome obstacles and improve adaptation, as the ideal approach to do what possesses traditional intelligence, emotional intelligence and adaptive intelligence together, which is not available to all, as "there are geniuses who are not creative", and intelligence without flexibility and adaptation alone makes one find it difficult to be the best. Today, organizations are looking for those who are able to adapt, where behavioral skills are the most important work today, and at the forefront of these skills is “preparing for flexibility, adapting to it and adapting to change".

Dr. Tariq Mehmood

Retail and Marketing

What is Social Media Marketing?

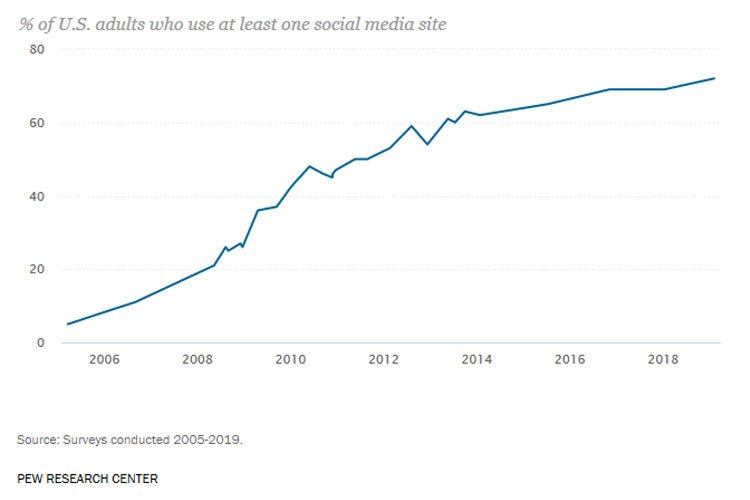

Social Media Marketing provides businesses the opportunity to leverage the power of social media platforms to connect with their audience.

Prof. Sakkthivel Annamalai Manickam

Retail and Marketing

Competition is the way of life in today’s corporate world, and companies spend billions anticipating, tackling, and winning over competitors either from the same industry or a different one.

Dr. Bashar Yaser Almansour

From Different Corners

The concept of cryptocurrency has been widely recognized in the last few years. These are digital currencies that make use of encryption for verification of a transaction. Bitcoin is a digital currency that was based on public-key cryptography. The major innovation in the case of Bitcoin is the decentralization of technology. The bitcoin database is distributed across a network of contributing computers, instead of storage of transactions on a single server. The database holding bitcoin database which is called “Blockchain” where blocks are added in the chain during the process of bitcoin mining. The mining process revolves around the solution of compound computational puzzles. In doing so, the miners receive the incentive of bitcoin rewards and transaction.

The bubble behavior of bitcoin is prompted by the noise traders which imply market inefficiency to increase, hence, there is a notion of experience of “fad” by the bitcoin market. The combination of different market news and events happen to have a strong effect in price volatility of bitcoin. The bubble-like behavior explains the increased volatility as a result of increased trading. The unsophisticated noise traders of bitcoin get easily affected by expectations and behaviors of other traders which can lead to “herding behavior, prospect behavior and heuristics behavior.” Hence, the decisions are mostly made in the light of heuristics instead of incorporating actual assessments.

From the behavioral finance point of view, the crowd activity literature is titled herding. The herding is described as a decision-making approach characterized by imitating other peoples’ behavior. It is also defined as a situation in which rational investors tend to act irrationally by imitating others’ judgments when it comes to making such investment decisions. It is stated that the herding factors affect asset prices significantly which this consider a part of the capital assets pricing theory. Moreover, herding can cause some emotional biases including conformity, congruity and cognitive conflict, the home bias, and gossip theories.

Traditional finance theory states that investors’ behavior is not significantly affecting the prices of assets. The argument behind that determined by investors’ demand that will be neutralized by the arbitrageurs’ transaction and by the trades, therefore, discounts the potential influence of the investors’ sentiment or investors’ feelings. Investors believe that they make their investment decision logically and rationally. However, the behavior finance theory states that investors’ behavior is significantly affecting the prices of assets. This indicated that behavior finance factors play a significant role in affecting investment decisions made by investors in the cryptocurrency market. As a conclusion, Behavioral Finance studies the psychology of financial decision-making. Most people know that emotions affect investment decisions. The behavioral finance holds out the prospect of a better understanding of financial market behavior and scope for investors to make better investment decisions based on an understanding of the potential pitfalls. The behavior finance factors play a significant role in influencing investment decisions made by investors in the cryptocurrency market.

Prof. Sakkthivel Annamalai Manickam

Retail and Marketing

Consumers today can access products and services from all the world, thanks to the globalization drive, which is uniting most of the countries. Thanks to the Internet, which created an information explosion and enabled the